The cost of lipedema surgery, specifically Lipedema Reduction Surgery (LRS), can be a significant financial investment. This page is to help you navigate the complexities of paying for your lipedema surgery. Understanding your payment options and potential insurance coverage is essential for making your best-informed decision.

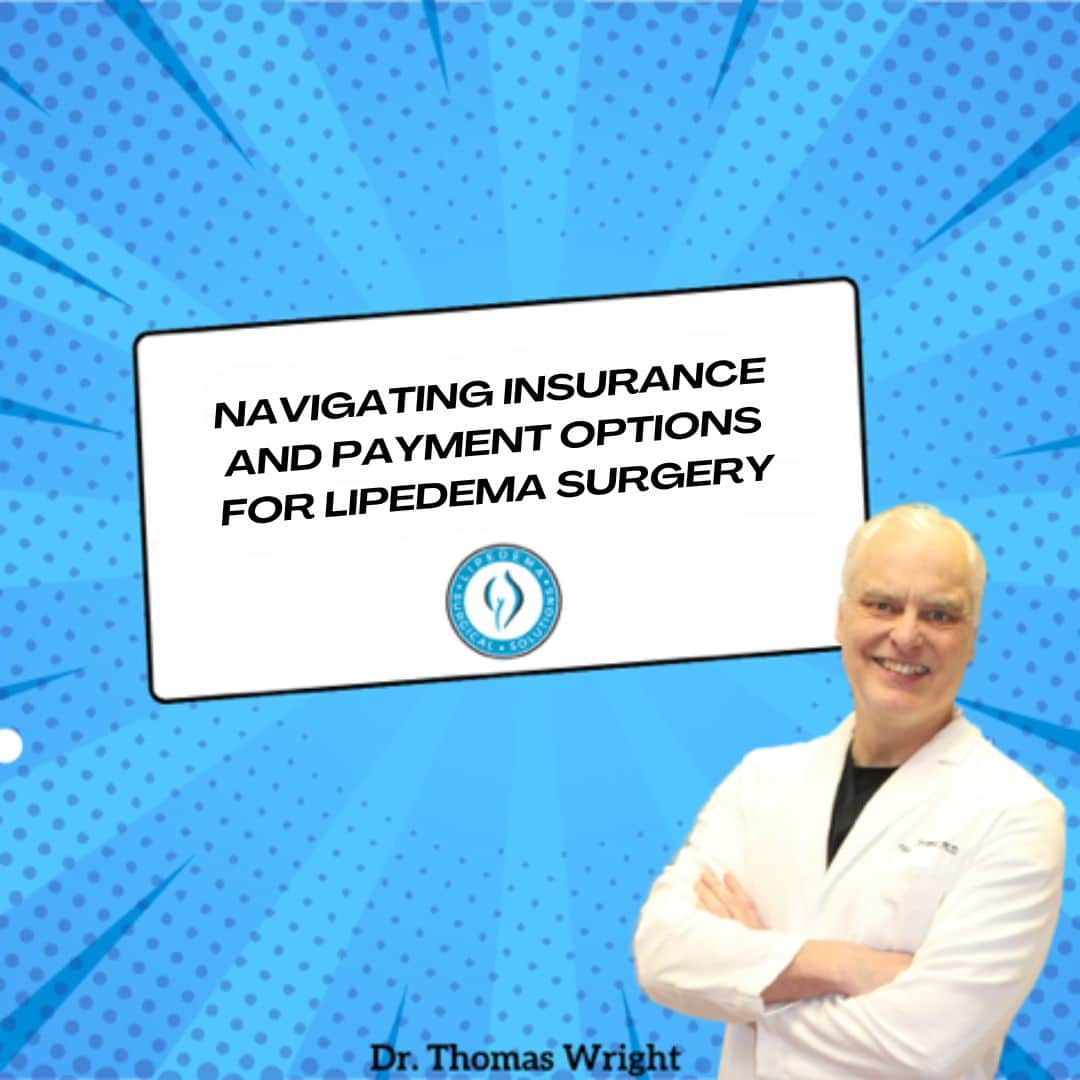

Two Ways to Pay for Your Lipedema Surgery

When paying for lipedema surgery, you generally have two main options: paying out-of-pocket (cash payment) or obtaining insurance coverage. Each method has its advantages and challenges.

- Patients have the option to pay cash.

- Patients have the option to go through insurance.

- Unfortunately, the patient must decide whether to pay cash or use insurance at the beginning of treatment. If you pay cash upfront, getting insurance to agree to cover the procedure retroactively can be difficult.

Paying Out-of-Pocket:

- Many patients opt to pay cash for their procedures. While it might seem counterintuitive, this option can sometimes be more cost-effective than going through insurance due to the complexities and additional charges associated with insurance claims.

Partial Payments Through Insurance:

- Even with the “best” insurance plans, there’s generally no full coverage for Lipedema Reduction Surgery. Inevitably, nearly all insurance companies over the last 25 years have shifted more and more of the cost of medical care to their insurance subscribers. These out-of-pocket costs include copays, coinsurance, facility fees, and deductibles. If you have filled a prescription for an antibiotic, you have likely experienced this cost shift; when you go to pay for the antibiotic, even though it is on the insurance company’s formulary for coverage, oftentimes it is less if you pay the cash price as opposed to using insurance.

Cost Uncertainties When Going Through Insurance

Insurance companies deny coverage or deem treatment unnecessary that is recommended by doctors and needed by their insured customers. Medical insurance companies have created all sorts of restrictions called “medical necessity criteria” to limit the treatments they will cover. Sadly, this is how insurers maintain their high profits, prodigious salaries, and bonuses for their executives. Furthermore, the companies have covered a substantially smaller percentage of the costs over the last 25 years, even when all the requirements/criteria have been met. Insurance companies put time limits on their approvals and often do not allow extensions even when treatment is expected to take longer than the allowed timeframe. This creates technicalities that later deny payment for approved lipedema surgeries.

In addition, deductibles and co-insurance restart at policy renewal dates and/or calendar years, which means they may have to be paid multiple times during the course of treatment. Many patients have high deductible plans, high coinsurance costs, and poor out-of-network coverage. So, even when the insurance agrees to cover treatment, the coverage is only a fraction of the total cost. When an authorization for treatment is received, it always contains the following disclaimer: this authorization is not a guarantee of payment. This means that even when they approve a procedure as medically necessary, they may still deny payment, which means the patient is left with a large, unexpected bill. With increasingly uncooperative insurance companies, more women with lipedema can save money by paying cash or using HSA/Flex spending money and itemizing the out-of-pocket medical expenses on their taxes.

Unreasonably Low Insurance Payments for Lipedema Surgery

Insurance companies have adopted a new tactic to increase their profits: paying only a pittance or an unreasonably low amount for Lipedema Reduction Surgery. This unfair and cynical approach “technically” covers lipedema surgery, but the coverage is so small that it is of no value to the insured patient. FAIRHealth.org has compiled data based on hundreds of thousands of paid medical claims and the actual and reasonable fees paid for lipedema reduction surgery by medical insurance companies. Going around the country, the total cost of one lipedema surgery ranges from $20,720 in Florida to $65,200 in California, based on fair health data. Missouri, Illinois, and New York are in the middle of the payment range for the total costs of the surgery.

Even though this fair and reasonable amount is what the insurance company should pay and is readily available to insurance companies, some will pay only a few hundred dollars for lipedema surgery and brazenly call this unbelievably low payment “a reasonable and customary fee.” This pittance will not even cover the cost of the sterile gowns and drapes used in the surgery. The only explanation for paying a few hundred dollars for the surgery – less than what they pay for an office visit – is that the insurance companies want to restrict complete lipedema care. This is very unfortunate because many women with lipedema cannot afford surgery without reasonable insurance coverage and untreated or partially treated lipedema can affect mobility, lessen quality of life, and lead to serious medical complications.

Many medical insurance companies will not negotiate the arbitrary and unsubstantiated low-ball fees they call “reasonable, “even when strong and irrefutable data support them as being anything but a reasonable payment for lipedema surgery. This unreasonable tactic amounts to essentially not covering Lipedema Reduction Surgery and leaving the patient on the hook for almost all the surgery costs, even when the insurance company technically approved the surgery.

How to Obtain Insurance Coverage for Lipedema Surgery

- Working with a Lipedema Surgeon: Many experienced surgeons, like Dr. Wright, have dedicated staff to help their established patients navigate the insurance process. These staff members handle all aspects of filing claims and appealing denials without additional charges. Until recently, this no-cost courtesy to patients by their doctors and staff was the primary way to get insurance coverage for surgical procedures.

- Using Outside Companies [A potential new cost to the process]: As medical insurance companies have made getting coverage and payment for patients’ medical needs more restricted, burdensome, and uncertain, some surgeons now require patients to hire external businesses to obtain coverage and payment. Businesses in this new space call themselves insurance advocates, advocates, patient advocates, and similar sounding titles. This newly created business opportunity is unregulated. These businesses do not have binding ethical and patient privacy guidelines requirements that physicians, nurses, and traditional healthcare organizations have. Most businesses and individuals in this space follow HIPAA patient privacy guidelines and best business practices* and do not attack or harass patients. However, there are a few bad actors who do not.

Some surgeons require patients to use external businesses to secure insurance coverage. If a surgeon requires you to use an outside service to obtain insurance coverage, they should share these costs upfront with the patient and include an estimate when they discuss their treatment plan.

Some insurance advocates steer referrals exclusively to surgeons who require the patients to use the insurance advocates, creating a cycle of referrals back and forth, which we believe is an unethical financial feedback situation and has the potential to be illegal. Some of these self-described “advocate” businesses charge initial fees (sometimes up to $1,200) and impose added fees for each additional step in the process. For example, an appeal cost is added if the predetermination or coverage is denied. This means they charge more and make more money if multiple denials occur. Getting a full estimate of these fees is crucial to make an informed decision.

How Lipedema Surgery Fees Work

The fee charged to an insurance company will always be much higher, usually twice as high or more than the original discounted cash price, because of the uncertainty of actually getting paid and the staff’s increased workload. The surgeon and their staff typically take 10-30 hours to get insurance approval for the treatment surgical plan of the lipedema reduction surgeries. This includes time spent preparing documents for a predetermination, the appeals process, and the claim submission process, as well as fighting the insurance company to follow through on their commitment to cover the surgery.

Sometimes, after all of this, the insurance company still does not pay for the procedure, even though they indicated to the surgeon and the patient that they would in the predetermination. The patient is ultimately responsible for any fees the insurance company does not pay, which will likely be significantly higher than the original option of the upfront cash discount. Ultimately, we are all individually responsible for knowing our financial commitments for our medical care.

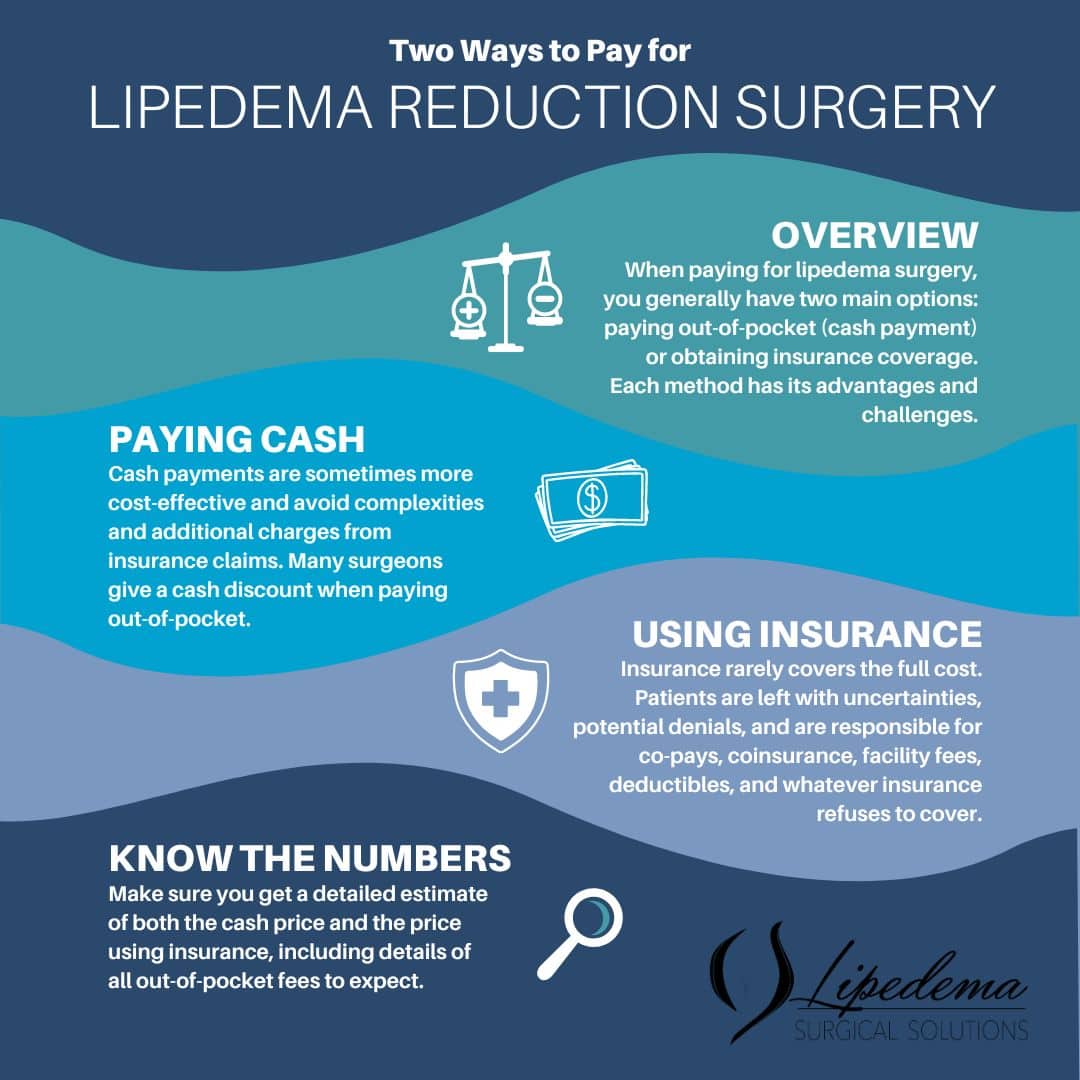

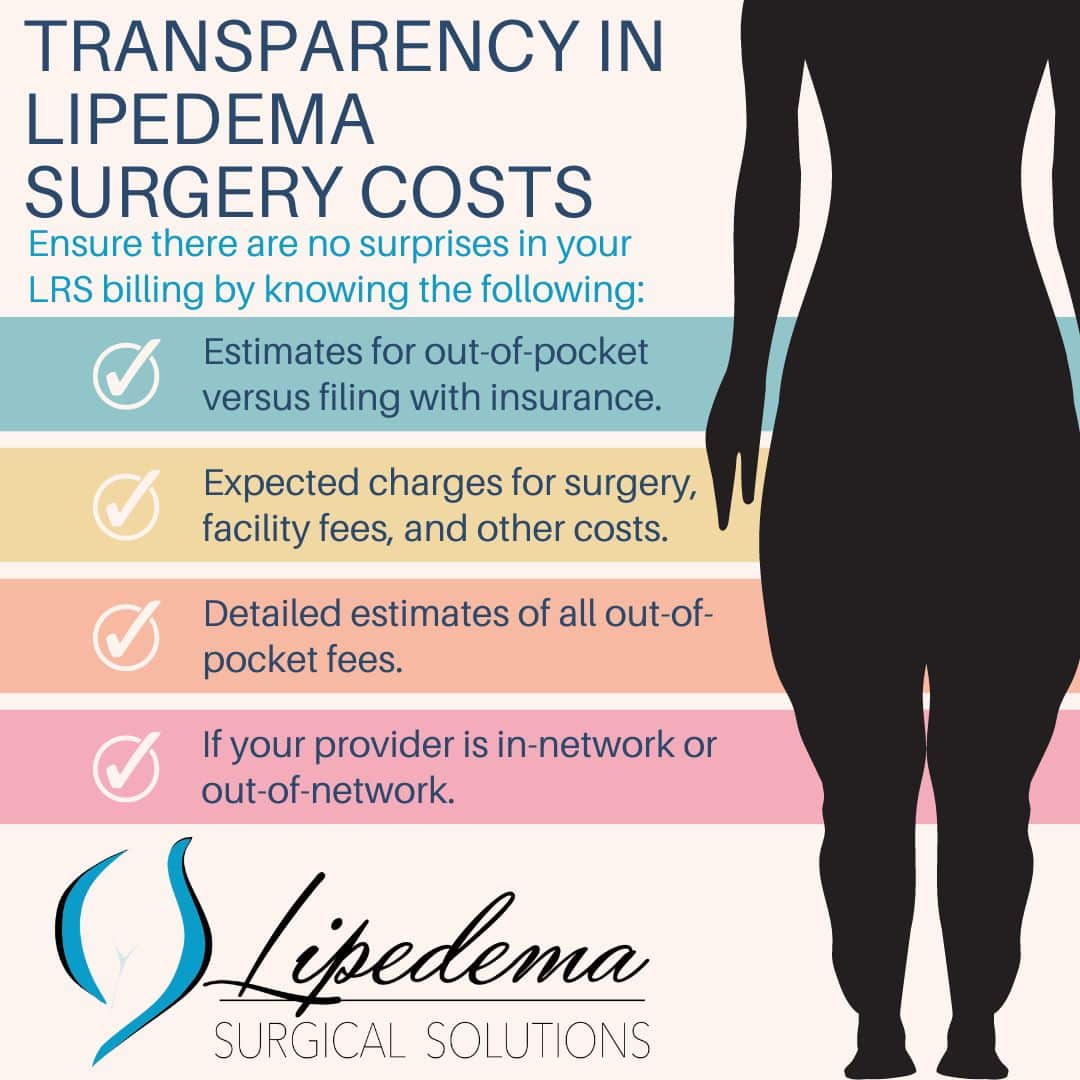

“No Surprise” Disclosure of Cost

Whether you pay cash or decide to go through insurance, a complete disclosure of costs should be provided before any procedure. This transparency ensures you fully know all potential costs before the procedure and have the right to a good-faith estimate of what to expect. A good faith estimate lists the expected charges for items or services based on the information available when the estimate is created. It may not include unknown or unexpected costs that could arise during treatment.

A good faith estimate should include things like the surgical fee, the facility fee, the cost of any outside insurance advocate business costs from the minimum to the maximum, deductibles, co-insurance, and other expected out-of-pocket fees. The provider and facility in-network or out-of-network status should also be disclosed.

Help with Lipedema Treatment & Lipedema Insurance Coverage

Preparing for lipedema reduction surgery involves careful consideration and planning. Whether you pay out-of-pocket or pursue insurance coverage, ensure you have all the necessary information to make an informed decision. At Lipedema.net, we are committed to providing you with the resources and support needed to manage lipedema effectively.

Contact us now for more information and to connect with top lipedema specialists who are ready to help you start the process.

*Best Practices for Health Care Businesses:

- Follow all HIPAA guidelines for all patients or clients. Maintain addresses and phone numbers on business websites. Post and maintain local and state business licenses for the address listed on the business website. Have Better Business Bureau listing and reviews. Have Google and Yelp business listings. Listing registration with relevant industry organizations such as local or state Health Care Advocate Associations. These “trust indicators” are crucial for businesses dealing with sensitive healthcare information or PHI [Protected Health Information]. It is considered a red flag if businesses do not have and display these policies and listings.

Keywords: Lipedema Surgery Payment Options, Insurance for Lipedema Surgery, Lipedema Reduction Surgery Costs