Lipedema is a condition that affects a significant number of women worldwide, causing pain, swelling, and mobility issues. While lymphatic sparing liposuction, which uses specialized techniques to reduce the risk of lymphatic injury, is an effective treatment option for managing the symptoms of lipedema, the question of insurance coverage for this procedure has been a source of frustration for many patients. One of the main reasons for this is that insurers currently use an inappropriate cosmetic code for lipedema surgery. This comprehensive guide will delve into the complex world of lipedema surgery and insurance coverage, shedding light on the challenges patients face and the steps they can take to navigate the system.

What is Lipedema?

Lipedema is a chronic condition characterized by an abnormal fat buildup, primarily in the legs, hips, and buttocks. This disproportionate distribution of fat can lead to pain, swelling, and mobility issues, significantly impacting a person’s quality of life. Unfortunately, lipedema is often misunderstood and misdiagnosed, leading to delays in treatment and management.

The Role of Lymph-Sparing Liposuction in Lipedema Treatment

While lifestyle modifications, such as diet and exercise, play a role in managing lipedema, for many women, they are insufficient to address the underlying fat accumulation. Lymph-sparing liposuction, also known as Lipedema Reduction Surgery, has emerged as a highly effective treatment option for patients with lipedema. This specialized surgical procedure targets and removes the excess fat and fibrotic tissue. It has been shown to decrease pain and swelling and improve mobility, quality of life, and knee mechanics while preserving the lymphatic system, minimizing the risk of complications. This is a reconstructive surgery geared toward improving pain and function and not a cosmetic procedure.

The Insurance Coverage Challenge

Obtaining insurance coverage for lipedema surgery is a significant hurdle for many patients. Insurance providers typically categorize liposuction as a cosmetic procedure using CPT codes 15877-79. Using cosmetic codes can lead to exclusions of coverage, even when there is evidence of improvement in pain and function from lipedema reduction surgery or lymph-sparing liposuction.

When cosmetic codes have no assigned description or value in the official CPT manual, the insurers are free to pay very little or a fair price for this surgery to in-network doctors. This is entirely at their discretion and can actually work against in-network coverage. These issues present major roadblocks for individuals with lipedema who require surgery to alleviate their symptoms and improve their quality of life.

One of the most significant benefits of working with a medical provider who is well-versed in lipedema is that they will often help their patients navigate the approval process and work for them to get coverage. Surgeons who assist with insurance coverage for their lipedema patients generally do not charge for their help, which can save you the additional costs some self-identified advocates charge.

Every insurance policy is different, even if the insurance company is the same; however, the steps below are an example of what insurance providers may require to gain coverage. In addition to the information below, it is crucial for patients to submit a detailed statement to their insurance provider about how lipedema impacts their daily lives. This additional step helps patients get approval. Your doctor and their team can often help with each step to give you the best chance of approval.

The Importance of Medical Necessity

One of the key factors in determining insurance coverage for lipedema surgery is establishing medical necessity. Insurance providers often require substantial evidence that the procedure is not cosmetic but medically necessary. This can include documentation of failed non-surgical treatments, clinical evaluations, and medical records demonstrating lipedema’s limitations on the patient’s physical and mental well-being. Medical insurance companies usually only cover the surgical treatment of lipedema when the disease significantly impacts instrumental functions in the patient’s daily life.

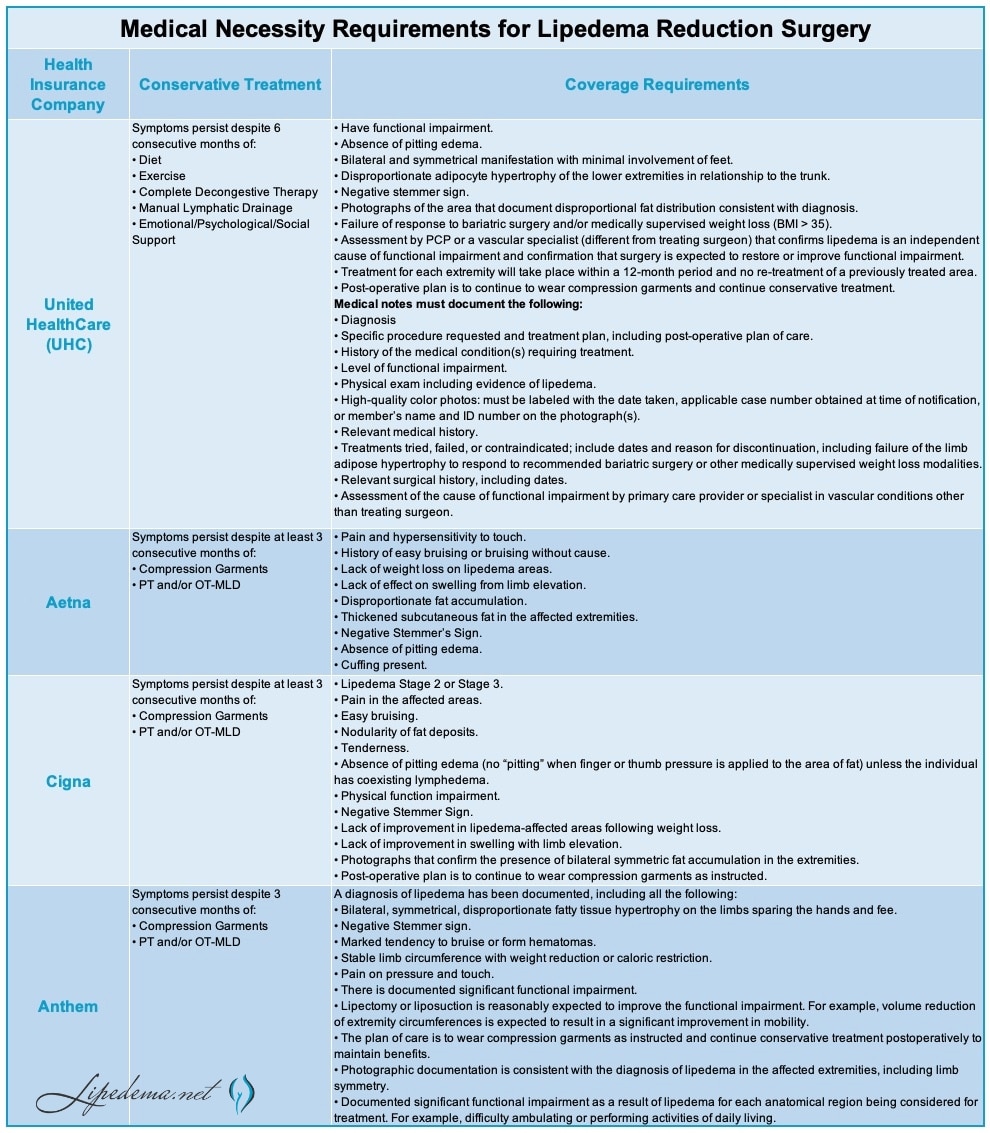

Below, we’ve summarized some of the requirements listed on insurers’ websites. Please check directly with the insurer’s policies to get the most up-to-date requirements using the links provided. Currently, Medicare/ Medicaid and all Medicare Advantage managed insurances do not cover lipedema reduction surgery or lymph-sparing liposuction for lipedema.

Website links to each insurance company: UHC, Aetna, Cigna

Learn more about United Healthcare Insurance for Lipedema here.

Medical Necessary Requirements for Lipedema Reduction Surgery

Website: MyUHC

Symptoms persist despite 6 consecutive months of:

- Diet

- Exercise

- Complete Decongestive Therapy

- Manual Lymphatic Drainage

- Emotional/Psychological/Social Support

- Have functional impairment.

- Absence of pitting edema.

- Bilateral and symmetrical manifestation with minimal involvement of feet.

- Disproportionate adipocyte hypertrophy of the lower extremities in relationship to the trunk.

- Negative stemmer sign.

- Photographs of the area that document disproportional fat distribution consistent with diagnosis.

- Failure of response to bariatric surgery and/or medically supervised weight loss (BMI > 35).

- Assessment by PCP or a vascular specialist (different from treating surgeon) that confirms lipedema is an independent cause of functional impairment and confirmation that surgery is expected to restore or improve functional impairment.

- Treatment for each extremity will take place within a 12-month period and no re-treatment of a previously treated area.

- Post-operative plan is to continue to wear compression garments and continue conservative treatment

Medical Notes

Website: Aetna Member Center

Website: MyCigna

Website: TRICARE Member Center

Employee Retirement Income Security Act (ERISA)

ERISA, which stands for the Employee Retirement Income Security Act, sets standards for retirement and health plans in private industry. Any employer-sponsored medical insurance plan is subject to ERISA regulations. This means that if there is no specific exclusion in the SPD (Summary of Plan Benefits) for lipedema surgery, then insurance coverage is required to provide coverage. This is another example of the benefits of working with a lipedema expert to navigate getting coverage. Many patients need to be made aware of their rights and coverage benefits.

Over 90% of commercial insurance is through employers, meaning they must comply with ERISA regulations. If you’re getting insurance coverage through your employment in the private sector, it’s likely that your policy falls under ERISA regulations. ERISA applies to most employer-sponsored group health plans in private industry, including those offered by non-governmental employers.

However, there can be exceptions based on the employer’s size and other factors. For example, certain church plans, government plans, and some small employer plans may be exempt from ERISA requirements. It’s always a good idea to review the specifics of your insurance plan or consult with your employer’s benefits department to understand the details of your coverage and whether ERISA applies.

What does ERISA insurance cover?

ERISA plans are plans, programs, or funds that were created or are maintained by an employer to cover medical, surgical, hospital, or sickness benefits or other benefits related to ERISA’s non-healthcare regulatory functions, according to the Compliance Administrators site.

Navigating the Insurance Approval Process

Securing lipedema surgery insurance coverage requires a thorough understanding of the approval process. It involves submitting a pre-determination or pre-certification request, providing supporting documentation, and potentially going through multiple rounds of appeals. While the process can be lengthy and challenging, persistence and a well-prepared case can increase the chances of a successful outcome.

The Role of Clinical Policy Bulletins

Insurance companies periodically change their policies and post them in policy bulletins on their website. These bulletins act as an announcement of changes in their medical coverage and as a guide that is often referenced when determining medical necessity for specific procedures. Regarding lipedema surgery, some insurance companies cite cosmetic surgery exclusions as a reason for denying coverage. Understanding the content and implications of these policy bulletins is crucial for patients advocating for insurance coverage. Please know that policies change frequently, and you should always check with your insurance provider for the most up-to-date policy.

The Power of Advocacy and Legal Action

*Best Practices for Health Care Businesses:

- Follow all HIPAA guidelines for all patients or clients. Maintain addresses and phone numbers on business websites. Post and maintain local and state business licenses for the address listed on the business website. Have Better Business Bureau listing and reviews. Have Google and Yelp business listings. Listing registration with relevant industry organizations such as local or state Health Care Advocate Associations. These “trust indicators” are crucial for businesses dealing with sensitive healthcare information or PHI [Protected Health Information]. It is considered a red flag if businesses do not have and display these policies and listings.

In cases where insurance denials persist despite significant medical evidence and appeals, patients may turn to advocacy and legal avenues for support. This can involve seeking assistance, engaging legal representation, or participating in class-action lawsuits. These efforts challenge insurance companies’ policies and practices, advocating for fair coverage for lipedema surgery.

There are many surgeons dedicated to treating lipedema who will do this for their patients without any extra charge. Of course, you can pay someone to do all the work, but it can be costly. There are some good ERISA experts that can help you but there is much of this you can do yourself. Anyone can call themselves an insurance advocate as there is no licensure or specific business registration requirements. Unlike physicians, they are not bound by privacy laws or ethical pledges. Most importantly, avoid businesses that have red flags or that interfere with the choice of your doctor or ongoing doctor-patient relationships. Look for signals of highly reputable businesses. You can use this guide to determine if a business is genuine.

What Should I Ask My Insurance Company?

The most important step is to ask your insurance company for your Summary Plan Description (SPD). This contains excellent information for navigating your coverage of surgery for Lipedema. You can request this from your insurance company directly or your Human Resources department if the insurance is through an employer. Having a copy of the Summary Plan Description is your first step to finding out if your lipedema surgery can be covered.

Make sure you get answers to each of the following questions.

Does my policy have out-of-network benefits?

What is the mailing address for the plan & employer?

What are covered expenses/eligible expenses – does my policy cover surgery in an outpatient surgery center?

Is authorization/pre-certification required?

- Note: If pre-certification is not explicitly stated in the SPD for an out-of-network provider, they cannot require or demand you get one before receiving services and cannot deny it after you have the procedure.

What do I need to submit a claim?

- Note: If this section does not require you to submit medical records, they cannot deny after you have the procedure for failure to submit your records, nor can they repeatedly request based on internal policy.

Are there any exclusions?

- Unless your procedure is specifically listed under the exclusions section, they cannot deny it for not being covered.

How are reimbursements for out-of-network providers made?

- In the definitions section or under mentioning how reimbursement for out-of-network providers is made, look for terms like allowed amount, customary and reasonable, and usual customary and reasonable.

- Ensure there is a definition detailing how out-of-network providers are paid for these type of procedures. There may be a fee schedule that you will have to request, such as a percentage of Medicare, geographic location, or FAIR health.

- Once payment is made to you or the provider, you should verify the payment is in accordance with this section.

Note: Some SPDs may also have a section regarding ‘special surgeries’ – see if there is anything in this section about your procedure.

Alternative Financing Options

For patients unable to secure lipedema surgery insurance coverage, alternative financing options may be available. Some medical providers offer self-pay programs or financing plans to help individuals manage the costs of the procedure. Many patients opt to use their FSA, HSA, or even Care Credit options to pay for their treatment. Exploring these options can provide a pathway to accessing the necessary treatment without relying solely on insurance coverage.

The Future of Insurance Coverage for Lipedema Surgery

As awareness of lipedema grows and more research supports the effectiveness of liposuction as a treatment option, there is hope for improved insurance coverage. Continued advocacy, education, and collaboration between healthcare professionals and insurance providers are essential in driving positive change for individuals with lipedema.

Conclusion

Lipedema surgery, particularly specialized lymph-sparing liposuction, also known as Lipedema Reduction Surgery, has the potential to improve the lives of individuals with lipedema significantly. However, obtaining insurance coverage for this procedure remains a significant hurdle for many patients. Patients can navigate the system and access the treatment they need by understanding the complexities of insurance coverage, advocating for medical necessity, and exploring alternative financing options.

We share this information in hopes that it helps thousands more women get insurance coverage for their lipedema surgery. This information is freely available, as it should be, but it can be challenging to collect and organize. As the landscape evolves, the collective efforts of patients and healthcare professionals will be crucial in driving positive change for individuals with lipedema.