We are pleased to announce that Dr. Wright accepts patients for Lipedema Reduction Surgery in-network with United Healthcare. We are delighted that United Healthcare is working with us to provide the lipedema patient community with in-network lipedema treatment options. Please be aware that United Healthcare’s medical necessity criteria must be met to their satisfaction before approval. This includes six months of conservative therapy (diet, exercise, compression), photo documentation showing disproportionate tissue of the extremities, and documentation of functional impairment. We also highly recommend that patients document their personal journey to share with their provider and UHC to prove their need for further treatment.

We aim to help the lipedema community obtain affordable in-network treatment and care. We will continue to work with other payers to achieve fair compensation for the expertise and outstanding patient care and outcomes we provide to our patients.

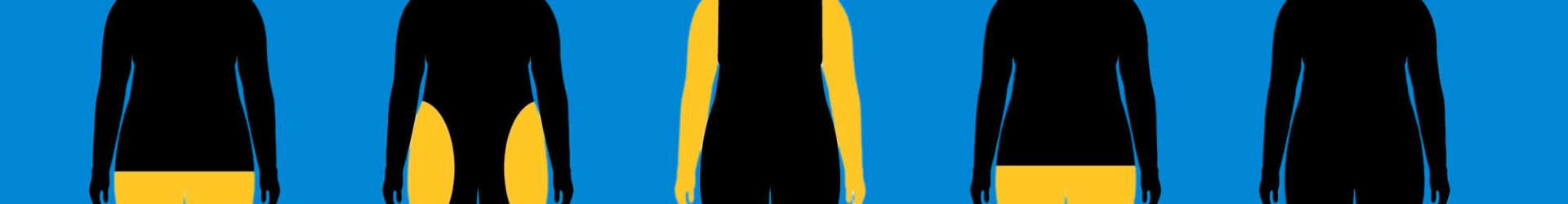

Lipedema is a chronic condition affecting many women, causing disproportional fat distribution and significant physical discomfort. Fortunately, UnitedHealthcare (UHC) Insurance offers lipedema treatment insurance coverage, but it’s essential to understand their strict criteria and the steps required to get the coverage you need. We’re here to guide you through obtaining lipedema insurance coverage through UHC while shedding light on Dr. Wright’s success in securing coverage for his patients.

United Healthcare’s Lipedema Coverage Policy

United Healthcare recognizes individuals’ challenges with lipedema and has developed a policy for treating this condition. However, it’s important to note that they have stringent criteria that must be met to qualify for lipedema covered by insurance. Below is the general outline of what criteria UHC is looking for. At the end of this article, we summarize the entire process that includes this criterion.

Criteria for Lipedema Treatment Insurance Coverage

To be eligible for treatment for lipedema covered by insurance through UHC, you must meet the following criteria:

Diagnostic Criteria: You must meet all diagnostic criteria for lipedema. This includes having photographs showing disproportional fat distribution consistent with the diagnosis. Additionally, you must have documented evidence of the failure of disproportional fat to respond to medically supervised weight loss or bariatric surgery if your BMI is in class 2 or above (BMI +35).

Conservative Therapy: You should have completed medically supervised conservative therapy for lipedema for at least six months. This therapy includes compression garments, manual lymphatic drainage (MLD), and a low-carb diet. Documenting your efforts is crucial. You must document if symptoms persist despite diet adherence and compression use.

Medical Evaluation: In addition to diagnosing lipedema, you’ll need another diagnosis from your primary care physician (PCP) or a specialist who is not providing surgery for lipedema. This diagnosis should support the need for surgical intervention to treat lipedema.

Functional Impairment: To further substantiate your coverage case, you must provide documentation of functional impairment. This could include how lipedema affects mobility, physical activity, and daily life. Be sure to detail the limitations you experience due to lipedema, as this will strengthen your case.

Dr. Wright’s Success with UHC Coverage

One positive aspect to highlight is that Dr. Wright has had significant success in helping his patients secure lipedema insurance coverage treatment through United Healthcare. This speaks to the importance of having a knowledgeable and experienced medical professional on your side when navigating the insurance process. His patients have seen great success with lipedema surgeries and long-term quality-of-life changes. Below he and one of his patients were featured on FOX 2 St. Louis!

The Process of Obtaining Lipedema Insurance Coverage

Now that you understand the criteria for UHC’s lipedema coverage policy, let’s outline the steps to help you secure the coverage you need:

- Consultation with a Specialist: Seek a specialist who can diagnose and document your lipedema. This specialist should not be the one providing surgical treatment. Make sure to discuss your functional impairment during this consultation.

- Conservative Therapy: Undergo medically supervised conservative therapy for at least six months. Keep detailed records of your therapy sessions, progress, and any lack of improvement.

- Medical Documentation: Request a separate diagnosis from your primary care physician or another specialist supporting surgical intervention to treat lipedema. This diagnosis should complement the lipedema diagnosis.

- Photographs: Obtain photographs showing the disproportional fat distribution consistent with lipedema.

- Consultation with Dr. Wright: If possible, consider consulting with Dr. Wright or a similarly experienced specialist who can guide you through the insurance process. Their expertise can be invaluable.

- Submission of Documents: Submit all the necessary documentation to UnitedHealthcare, ensuring that you meet all the criteria outlined in their policy. Include your personal notes and information about your journey in this submission.

- Advocacy: Be prepared to advocate for yourself and your need for treatment. Insurance processes can be complex, but persistence can pay off.

United Healthcare does offer coverage for lipedema treatment, but they have strict criteria that must be met. By following the steps outlined in this article and enlisting the expertise of a knowledgeable specialist like Dr. Wright, you can increase your chances of obtaining the coverage you need to manage and treat your lipedema effectively. Remember that your health and well-being are worth the effort required to navigate the insurance process successfully.

Read more about the UHC Policy here.

We will make every effort to get patients approved for Lipedema Reduction Surgery; however, final approval for medical necessity and prior authorization is determined by United Healthcare and at the discretion of a Medical Director at United Healthcare. We cannot guarantee patients will be approved for surgical procedures.

Why Aren’t More Health Insurance Companies Covering Treatment for Lipedema?

The general rule of thumb for Lipedema Insurance Coverage claims reimbursements is that any given claim must be deemed “medically necessary”. Lymph Sparing Liposuction is nearly always considered a cosmetic surgical procedure in nature or experimental, meaning this is an elective procedure and not a medical necessity. Of course, as explained above, this is not the case for women with Lipedema, as lymph-sparing liposuction is the only treatment option for dealing with this disease that can reverse progression. However, the combination of the surgery being deemed cosmetic and election plus the general under-education and lack of awareness in the medical community has led to the battle patients and Lipedema surgeons are fighting. We must educate and advocate for these surgeries to be covered.

Coding Lipedema Surgery with Cosmetic CPT Codes 15877-79

The liposuction CPT codes 15877-79 are cosmetic codes that were never intended to be used by commercial insurers to cover reconstructive or medically necessary procedures to improve function and technically should not be used for reconstructive treatment. Because they are cosmetic codes and are not covered by Medicare, they have never had a value or RVU (Relative Value Units) assigned to them. Some medical insurers like Blue Cross Blue Shield exploit the lack of an assigned value for the codes they insist on using. If an insurance company assigns little or no value to the surgery, even when it is a covered benefit, they can pay less for the 5-hour surgery than for a 15-minute follow-up office visit. This means that because they use cosmetic codes 15877-79, which can have little or no value assigned by commercial payers like Blue Cross Blue Shield, they can pay so little that they are, for practical purposes, technically “covering” treatment. But in practice, they’re not covering liposuction to treat lipedema. The good news, at least for now, is that UHC is covering Lipedema Surgery with a reasonable assigned value.

Contact a Specialist, Even If You Don’t Think Insurance Will Cover!

Despite the challenges and lack of coverage, some physicians, like Dr. Wright in St. Louis, do everything they can to work with patients to get insurance coverage. They are familiar with the ins and outs of different insurance providers, and their teams work extremely hard to get patient coverage. ERISA experts and attorneys can help you work on lipedema treatment coverage, and physicians can help you connect with them if you aren’t sure where to start.

You might also come across individuals who are self-described as “patient advocates”. These individuals will present themselves as experts in getting coverage for you. Still, they’re not licensed individuals and are unlikely to be bound by patient privacy laws that you’ll get with physicians and attorneys. We are aware of players in this field who are bad actors and ultimately hurt the cases of patient coverage. Be sure to check the BBB listings, names, and addresses of anyone wanting to work with you, along with Google Reviews and website listings.

Please reach out to our office, and Dr. Wright’s team would be happy to refer you to experts depending on where you are in your Lipedema diagnosis and treatment journey. We’re here to help, and happy to get you started!